Xiaomi is now bored of low-cost smartphones, wanting to `` dry blood '' with Huawei in the high-end segment

" Xiaomi has removed the price limit. This is when we entered the high-end segment, " Lei Jun, Xiaomi's founder and CEO, wrote on Weibo.

According to many technology experts, the launch of Mi 10 is an indication that Xiaomi is focusing more on the high-end segment, after a long time focusing on mid-range and popular smartphones with configuration models. Strong image compared to the price range.

In other words, Xiaomi now wants to compete directly with Huawei, which holds the No. 1 position in the Chinese smartphone market today. According to SCMP, Huawei now accounts for 80% of the high-end smartphone market share in China, while Oppo, Xiaomi and Vivo share the remaining 20%.

Xiaomi wants to shake off the label of only making low-cost phones to enter the high-end segment

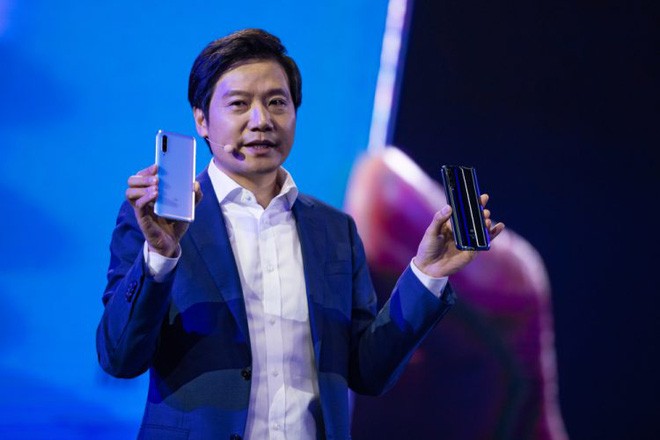

" The Mi 10 duo will be the first product to help the company move into the high-end segment, " Xiaomi founder Lei Jun revealed in an interview after the smartphone was launched. " I think our previous customers were mostly young people. Now, Xiaomi will make every effort to gain acceptance from high-end smartphone users. "

" Oppo and Xiaomi have experienced miraculous growth in the past few years thanks to the adoption of unique business models (when launching low-cost but well-configured smartphones). However, this strategy is gradually losing. efficiency, while competitors can easily copy the 'steps' of Oppo and Xiaomi, "said Nicole Peng, vice president of mobile market research at Canalys said.

" The move to the high-end segment is not merely a strategy of price. It also shows that both Oppo and Xiaomi are confident in the technology they have. The biggest challenge they will face. is how to satisfy the advanced user audience, which is very fastidious and always looking for the highest possible experience . "

Xiaomi Mi 10 and Mi 10 Pro will be the weapons that help Xiaomi compete with Huawei

Last month, Xiaomi announced the Mi 10 and Mi 10 Pro high-end smartphones with prices of about $ 570 and $ 720 respectively. Meanwhile, Oppo has also launched the Find X2 flagship model with a starting price of about $ 785. It can be seen that these are products with a much higher price than the two smartphone brands that launched several years ago.

" February and March are always the fiercest time of the year, when manufacturers launch top and high-end smartphones . Everyone now has the same question: Why is the price of electricity sold? phone increasingly high? ", Xiaomi vice president Lu Weibing wrote on Weibo." In fact, today, if you want to develop a high-end smartphone as possible, you have to use components. best, most expensive at all costs ".

According to SCMP, a series of Chinese phone makers such as Xiaomi, Huawei, Oppo and Vivo have expected sales to grow significantly with the launch of 5G-enabled smartphones, which are base-compatible. Telecommunication infrastructure has been widely deployed in the country of billion people.

However, the rapid spread of the COVID-19 epidemic in China in January and February has caused this hope to fail. A series of smartphone production lines in China have been temporarily shut down, as authorities have ordered blockades of some cities and restrictions on crowds.

As a result, a number of market research companies have given a gloomy picture to Chinese smartphone makers in 2020, when sales plummeted. According to Canalys and Strategy Analytics, the number of smartphones sold in Q1 this year declined by 50% compared to Q1 / 2019. Meanwhile, market research firm IDC has forecast a 30% decline.